IRS Form 941

What Is IRS Form 941?

If you operate a business and have employees working for you, then you likely need to file IRS Form 941, Employer’s Quarterly Federal Tax Return, four times per year. As an employer, you are responsible for withholding federal income tax and other payroll taxes from each employee’s paycheck and remitting it to the IRS. Each Form 941 you file reports the total amount of tax you withheld during the quarter.

Who must file Form 941?

Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters. The only exceptions to this filing requirement are for seasonal employers who don’t pay employee wages during one or more quarters, employers of household employees and employers of agrricultural employees.

What are Form 941 filing deadlines?

Since you must file a separate form for each quarter, the IRS imposes four filing deadlines that you must adhere to. The deadlines are April 30, July 31, Oct. 31 and Jan. 31 of each year. Just remember that the filing deadline always falls on the last day of the month following the end of the quarter. This gives you one month to prepare the form before submitting it to the IRS.

How to fill out Form 941?

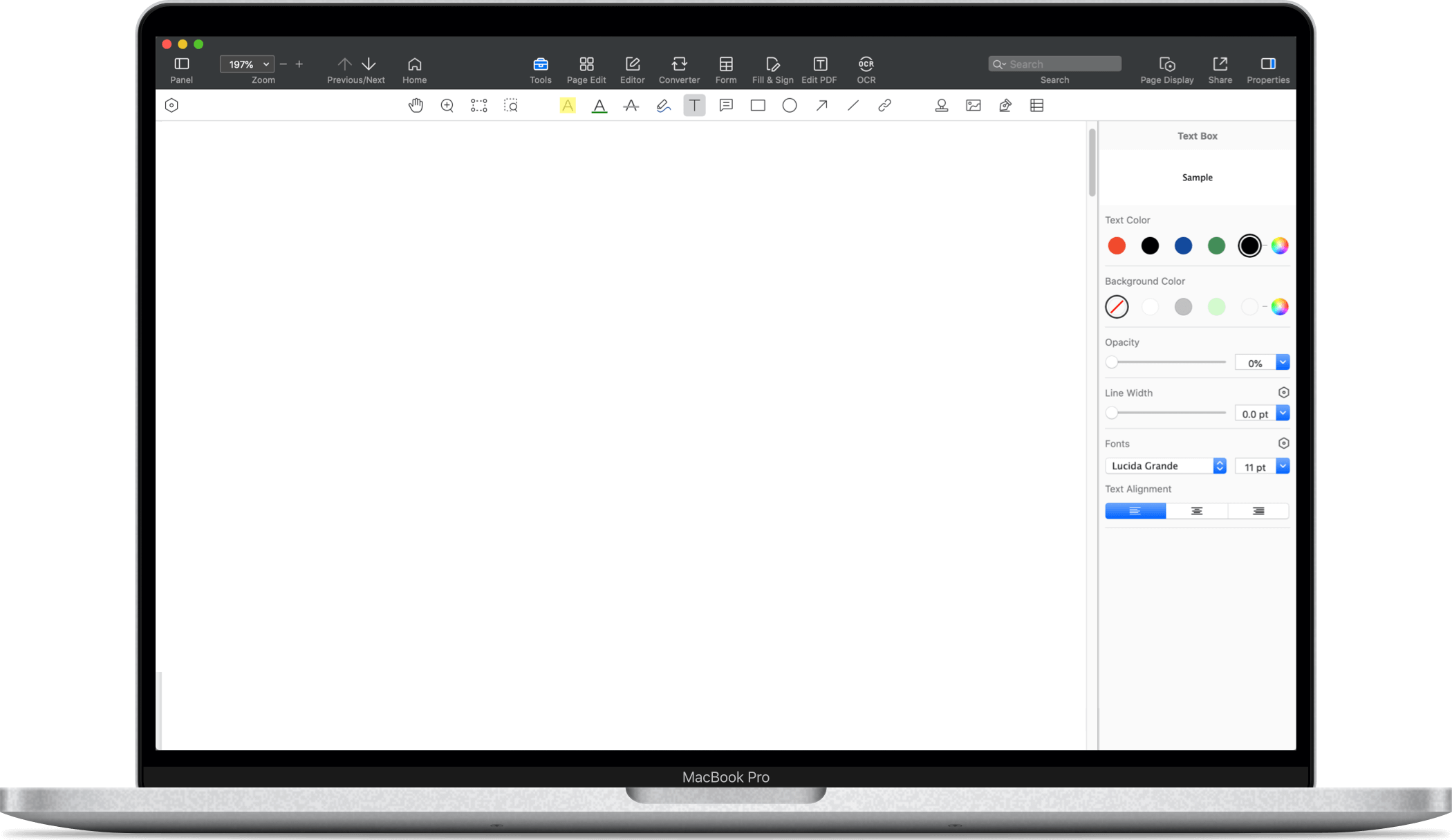

1. Gather Form 941 information Before you can begin filling out Form 941, you must collect some information. Gather the following to fill out Form 941: Basic business information, such as your business’s name, address, and Employer Identification Number (EIN) Number of employees you compensated during the quarter Total wages you paid to employees in the quarter Taxable Social Security and Medicare wages for the quarter Total federal income, Social Security, and Medicare taxes withheld from employees’ wages during the quarter Employment tax deposits you’ve already made for the quarter Wage information pertaining to coronavirus-related tax credits, if applicable (2020 Form 941) Information about deferred Social Security tax, if applicable (2020 Form 941) Information about paid sick or family leave wages, if applicable (2020 Form 941) Information about employer and/or employee Social Security tax deferral, if applicable (2020 Form 941) 2. Fill out business information At the top portion of Form 941, fill in your EIN, business name, trade name (if applicable), and business address. Off to the right side, mark which quarter the information is for. For example, if the form is for the third quarter, put an “X” in the box next to “July, August, September.” form 941 2020 quarter 3 and 4 3. Fill in necessary sections on the form Below is a box-by-box breakdown to help you fill out the rest of the form. Form 941 is broken into five parts, each with their own sections. Depending on your business and employees, you might not need to complete all of the sections. When filling out coronavirus-related sections on the 2020 Form 941, keep in mind that wages paid under the FFCRA (Families First Coronavirus Response Act) aren’t subject to the employer share of Social Security tax. Part 1: Questions for the quarter Part 1 has 15 lines. Some lines have multiple parts (i.e., 11a, 11b, etc.). Here are details about each of those lines and what information you must provide. Line 1 List the number of employees you paid during the quarter. This includes any employees who received wages, tips, and other compensation. Per the IRS, only include the total number of those who worked on these dates or during pay periods that include these dates: March 12 (Q1), June 12 (Q2), September 12 (Q3), and December 12 (Q4). If you’re using the July 2020 version of Form 941, you can only report wages, tips, and other compensation for Quarter 3 (September 12) and Quarter 4 (December 12). Say you have 11 employees working during September. Only 10 of the employees work during the pay period of 9/1 – 9/13. Because only 10 employees worked on or through September 12, you would only report “10” on Line 1. If you enter more than 250 employees on line 1, you must file Form 941 electronically. Line 2 Report the total compensation you paid to the applicable employees during the quarter. Include all wages, tips, and other compensation. Line 3 List the federal income tax withheld from employee compensation. Don’t include any income tax withheld by a third-party sick payer, if applicable. Line 4 If no employee compensation is subject to Social Security and Medicare taxes, mark an “X” next to “Check and go to line 6” on line 4. If you mark that box, you can skip lines 5a, 5b, 5c, 5d, 5e, and 5f. If employees do have compensation subject to Social Security and Medicare taxes, fill out lines 5a-5d next. Lines 5a-5d The most confusing lines on Form 941 are 5a-5d. To calculate the totals for these lines correctly, break up the wages by type (e.g., regular wages or tips). Lines 5a-5d are the totals for both the employee and employer portions of Social Security and Medicare taxes withheld from an employee’s wages. On lines 5a and 5b, you must multiply taxable Social Security wages (5a) and taxable Social Security tips (5b) by 0.124. The decimal represents the rate of Social Security tax on taxable wages. Both you and your employee must contribute 6.2% each paycheck for Social Security. Combined, you and your employee contribute 12.4%, which is the amount you multiply on lines 5a and 5b (0.124). For the 2020 version of Form 941, multiply qualified sick leave wages (5a(i)) and qualified family leave wages (5a(ii)) by 0.062 for Social Security tax. Because qualified sick leave and family leave wages aren’t subject to the employer portion of Social Security tax, you only need to multiply those wages by 6.2% (0.062). Qualified sick leave and family leave wages are required for applicable situations under the FFCRA. For 2020, the Social Security wage base is $137,700. This means only the first $137,700 of an employee’s annual income is subject to Social Security tax. Do not include any wages above $137,700 on lines 5a-5d (including lines 5a(i) and 5a(ii)). On line 5c, multiply taxable Medicare wages and tips by 0.029. You and your employee must both contribute 1.45% each paycheck for Medicare taxes. Combined, you and your employee pay 2.9%, which is 0.029. Medicare tax does not have a wage base. However, you must withhold an additional 0.9% for Medicare tax once an employee meets one of the following thresholds: Single with an annual income of $200,000 or more Married filing jointly with an annual income of $250,000 or more Married filing separately with an annual income of $125,000 or more If applicable, account for the additional 0.9% on line 5d by multiplying taxable wages and tips subject to additional Medicare tax withholding by 0.009. Let’s look at an example of calculating totals for lines 5a-5d for an employee. Say your employee earns $30,000 in regular wages and $2,000 in tips during the quarter. You did not have to pay the employee any sick leave or family leave wages. Line 5a: Taxable Social Security wages x 0.124 Line 5a(i): Qualified sick leave wages x 0.062 Line 5a(ii): Qualified family leave wages x 0.062 Line 5b: Taxable Social Security tips x 0.124 Line 5c: Taxable Medicare wages and tips x 0.029 Line 5d: Leave blank if employee doesn’t earn more than the applicable Medicare threshold Line 5a: $30,000 x 0.124 = $3,720.00 Line 5a(i): $0 x 0.062 = $0.00 Line 5a(ii): $0 x 0.062 = $0.00 Line 5b: $2,000 x 0.124 = $248.00 Line 5c: $32,000 x 0.029 = $928.00 Line 5d: Leave blank Fill out Columns 1 and 2 with the correct totals based on your wages and calculations. Be sure to separate the dollar and cents amounts on the form. For example: form 941 5a-5d information Line 5e Add the totals from Column 2 for 5a, 5a(i), 5a(ii), 5b, 5c, and 5d together to fill in the total on line 5e. Using the same data from above, you would input $4,896.00 on line 5e ($3,720 + $248 + $928). Line 5f Line 5f is specifically for documenting tax due on unreported tips. The IRS may issue a Section 3121(q) Notice and Demand to employers. This notice tells you about the amount of tips received by employees that were unreported (e.g., employee failed to report tips or underreported tips to their employer). If you receive a notice, fill in the amount the notice lists on line 5f. Do not fill out line 5f if you did not receive a notice from the IRS. Line 6 To get your total for line 6, add together totals from lines 3, 5e, and 5f (if applicable). Line 6 is the total amount of taxes you owe before any adjustments. Line 7 Fill out line 7 to adjust fractions of cents from lines 5a-5d. At some point, you will probably have a fraction of a penny when you complete your calculations. The fraction adjustments relate to the employee share of Social Security and Medicare taxes withheld. The employee portion of Social Security and Medicare taxes from lines 5a-5d may differ from the amounts you actually withheld from employees’ wages due to rounding. For example, say your employee had a tax liability of $2,225.212. You can’t send 21.2 pennies to the IRS. Instead, you round the penny amount down to 21 cents. Line 7 is for you to report these types of penny discrepancies. Say you paid $5,500.14. Your form states you should have paid $5,500.16. You would put -.02 on line 7 to show the penny discrepancy. The fractions of cents adjustment can be either a positive or negative amount. Be sure to use the negative sign (not parentheses) to show a decrease. Line 8 Fill out line 8 if you have a third-party sick payer, such as an insurance company. Calculate third-party sick pay for the quarter and enter the total on line 8 as a negative (e.g., -$130). Line 9 Line 9 relates to line 5f. However, line 9 is for recording adjustments for uncollected Social Security and Medicare taxes on tips and uncollected employee taxes on group-term life insurance. On line 9, enter a negative amount for: Any uncollected employee share of Social Security and Medicare taxes on tips The uncollected employee share of Social Security and Medicare taxes on group-term life insurance premiums paid for former employees Don’t fill in line 9 if you do not have any uncollected taxes for tips (Social Security and Medicare taxes) or group-term life insurance (employee share of taxes). Line 10 On line 10, fill in the total taxes after your adjustments (if applicable) from lines 6-9. Add the totals from lines 6-9 and fill in the sum on line 10. Line 11a Line 11a is specifically for a payroll tax credit for increasing research activities. If this credit applies to you, enter the amount of credit from Form 8974, line 12. You must also attach Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities, to Form 941. Do not fill in line 11a if this credit does not apply to your business. Line 11b Businesses and tax-exempt organizations that are required to provide coronavirus paid sick leave and/or paid family leave are eligible to claim a credit for qualified sick and family leave wages for the period after March 31, 2020 and before January 1, 2021. On line 11b, enter the nonrefundable portion of the credit for qualified sick and family leave wages from Worksheet 1, Step 2, line 2j (if applicable). Do not fill out this line if the credit does not apply to you. Line 11c On line 11c, enter the nonrefundable portion of the Employee Retention Credit (ERC) from Worksheet 1, Step 3, line 3h (if applicable). The ERC is 50% of the qualified wages you paid to your employees in the quarter. For Quarter 2 only, the credit includes 50% of the qualified wages paid between March 13, 2020 and March 31, 2020. Do not fill out line 11c if the ERC does not apply to your business. Line 11d Line 11d is the total nonrefundable tax credits from lines 11a, 11b, and 11c. Add together lines 11a, 11b, and 11c (if applicable) and input the total on line 11d. Line 12 Record your total taxes after adjustments and nonrefundable credits on line 12. Subtract line 11d from line 10 and enter your total on line 12. According to the IRS, You can either pay your amount with Form 941 or deposit the amount if both of the following are true: Line 12 is less than $2,500 or line 12 on your previous quarterly return was less than $2,500 You didn’t incur a $100,000 next-day deposit obligation during the current quarter You must follow a deposit schedule if both of the following apply to you: If line 12 is $2,500 or more and line 12 on your previous quarterly return was $2,500 or more You incurred a $100,000 next-day deposit obligation during the current quarter Line 13a List your total deposits for the quarter on line 13a. If you had any overpayments from previous quarters that you’re applying to your return, include the overpayment amount with your total on line 13a. Also, include any overpayment you applied from filing Form 941-X or 944-X in the current quarter. Line 13b On line 13b, include the combined amount of the employee and employer share of Social Security tax that you are deferring for the quarter. The CARES Act allows employers to defer the deposit and payment of the employer share of Social Security tax for the remainder of 2020. The president also issued four executive orders, one being an employee Social Security tax deferral. The employee SS tax deferral lets eligible employees temporarily defer the employee portion of Social Security tax until December 31, 2020. Enter the amount of the employer and/or employee portion of Social Security tax you deferred for the quarter on line 13b, if applicable. If you deferred both, be sure to add them together and input the total on line 13b. Keep in mind that you can’t defer Social Security tax that you have already paid. For more information on how to fill out your total Social Security tax deferral amount for line 13b, check out the IRS’s Form 941 Instructions. Line 13c If you provided coronavirus paid sick or paid family leave to employees during the quarter, enter the refundable portion of the credit for qualified sick and family leave wages from Worksheet 1, Step 2, line 2k on line 13c. Line 13d On line 13d, enter the refundable portion of the Employee Retention Credit from Worksheet 1, Step 3, line 3i. The refundable portion of the credit is allowed after the employer share of Social Security tax is reduced to zero by nonrefundable credits. Line 13e Line 13e includes the total deposits, deferrals, and refundable credits. Add lines 13a, 13b, 13c, and 13d, and enter the total on line 13e. Line 13f On line 13f, input the total advances you received from filing Forms 7200 for the quarter. Form 7200 lets you request an advance payment from the IRS. If you filed a Form 7200 before the end of the quarter but have yet to receive the advance before filing Form 941, do not include that amount on this line. If you did not file any Forms 7200 during the quarter, do not fill out this line. Line 13g Line 13g includes your total deposits, deferrals, and refundable credits less advances. Subtract line 13f from line 13e, and input the total on line 13g. Line 14 If line 12 is more than line 13g, enter the difference on line 14. You do not have to pay if your line 14 total is under one dollar. Do not fill out line 14 if line 12 is less than line 13g. Move on to line 15. Line 15 If line 13g is more than line 12, enter the difference on line 15. Do not fill in both lines 14 and 15. Only fill out one of these lines. If line 15 is under one dollar, the IRS will send a refund. Or, the IRS can apply it to your next return if you ask them to do so in writing. Part 2: Deposit schedule and tax liability for the quarter In Part 2, fill out information about whether you’re a semiweekly or monthly depositor. If you’re not sure which type of depositor you are, check IRS Publication 15, section 11. Next to line 16, you will see three boxes. Mark an “X” next to the first box if: Line 12 on your Form 941 was less than $2,500 Line 12 on your previous quarterly return was less than $2,500 You didn’t incur a $100,000 next-day deposit obligation during the current quarter. If you were a monthly depositor for the entire quarter, put an “X” next to the second box and fill out your tax liability for Months 1, 2, and 3. Your total liability for the quarter must equal line 12 on your form. If you were a semiweekly depositor during any part of the quarter, mark an “X” next to the third box. You must also complete Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941 if you were a semiweekly depositor. form 941 2020 part 2 Part 3: About your business Above the section for Part 3, enter your business name and EIN one more time. Part 3 includes lines 17-25 and asks you certain questions about your business. If a question does not apply to your business, leave it blank. The information on lines 19-25 are the amounts that you use on Worksheet 1 to figure the credit for qualified sick and family leave wages and the ERC. If you are claiming these credits, enter applicable amounts on lines 19-25. Line 17 Part 3, line 17 asks you whether your business closed or stopped paying wages during the quarter. If you did close your business or stopped paying wages in the quarter, place an “X” next to the box that says “Check here.” Then, enter the final date you paid wages. Also, attach a statement to your return. Line 18 If you are a seasonal employer and don’t have to file Form 941 every quarter, put an “X” next to “Check here” on line 18. Line 19 On line 19, enter the qualified health plan expenses allocable to qualified sick leave wages, if applicable. You must also enter this amount on Worksheet 1, Step 2, line 2b. Line 20 Enter the qualified health plan expenses allocable to qualified family leave wages on line 20. You must also enter this total on Worksheet 1, Step 2, line 2f. Line 21 Enter the qualified wages for the ERC (excluding the amount of any qualified health plan expenses allocable to these wages) on line 21. Also enter this amount on Worksheet 1, Step 3, line 3a. Line 22 On line 22, input the qualified health plan expenses for the ERC. These expenses are generally allocable to the wages reported on Form 941, Part 3, line 21. Also enter the amount from line 22 on Worksheet 1, Step 3, line 3b. Line 23 If applicable, enter the credit amount from line 11 of Form 5884-C for the work opportunity credit for qualified tax-exempt organizations hiring qualified veterans for this quarter on line 23. Entering an amount on line 23 does not change your requirement to file Form 5884-C separately from Form 941. Line 24 On line 24, enter the deferred amount of the employee share of Social Security tax from line 13b. The IRS will use line 24 to help determine the amount of the employer share of SS tax on line 13b. If you’re using the April 2020 version of the form, enter the qualified wages for the Employee Retention Credit (excluding the amount of any qualified health plan expenses allocable to these wages) paid March 13, 2020 – March 31, 2020. Also include this amount on Worksheet 1, Step 3, line 3c. Line 25 Leave line 25 blank on the July 2020 version of Form 941. It is a line reserved for future use. If you’re using the April 2020 version of the form, input the qualified health plan expenses for the ERC on line 25. part 3 form 941 2020 quarter 3 and 4 Part 4: Third-party designee Part 4 asks permission for the IRS to speak with your third-party designee. Your third-party designee is the individual (e.g., employee or tax preparer) who prepared Form 941 and is typically responsible for payroll tax prep. If you want your third-party designee to be able to discuss your return with the IRS, mark an “X” next to the “Yes” box. Then, fill in the designee’s name and phone number. You must also select a five-digit PIN to use when talking to the IRS (e.g., 12345). If you do not want another person to be able to discuss the return with the IRS, check off the box next to “No” and move on to Part 5. The example below shows what it would look like if you chose “Yes.” how to fill out form 941 Part 5: Signature After you complete all of the above sections, sign your form under Part 5. The following people can sign Form 941: Sole proprietorship: Individual who owns the company Corporation or an LLC treated as a corporation: President, vice president, or other principal officer Partnership or an LLC treated as a partnership: Partner, member, or officer Single-member LLC: Owner of the LLC or a principal officer Trust or estate: The fiduciary One of the authorized signers from above must sign Form 941 in the box next to “Sign your name here.” The signer must also print their name and title (e.g., president) and include the date and their phone number. If you have someone else prepare Form 941 on your company’s behalf, the preparer must fill out the Paid Preparer Use Only section. This section includes the preparer’s name, signature, firm’s name, address, phone number, EIN, and date. Your preparer must also check off whether or not they’re self-employed. form 941 part 5 quarter 3 and 4 After you complete all three pages of 941 and sign it, you’re ready to submit your form to the IRS. 4. Submit Form 941 Where you file Form 941 depends on your state and whether you make a deposit with your filing. To find out where to mail Form 941, check out the IRS’s website. You might also be able to electronically file Form 941, depending on your business and state. File a new Form 941 with the IRS every quarter. Because Form 941 is a quarterly form, it has multiple due dates: April 30 for Quarter 1 (January 1 – March 31) July 31 for Quarter 2 (April 1 – June 30) October 31 for Quarter 3 (July 1 – September 30) January 31 for Quarter 4 (October 1 – December 31) For additional details on filling out Form 941 and sending it to the IRS, consult the IRS’s Instructions for Form 941. After downloading the free Form 941 template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master